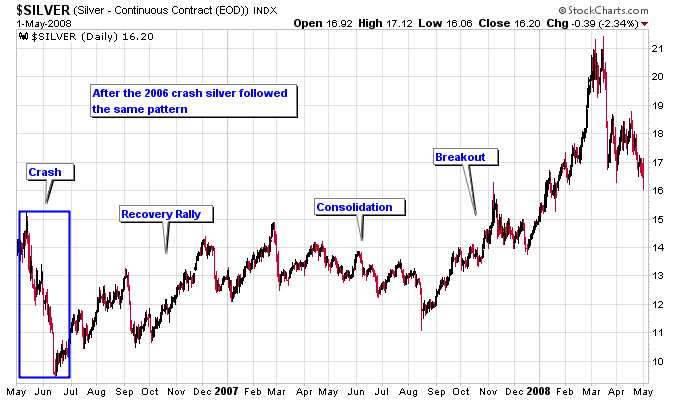

Silver has followed a repetitive spike, crash, and consolidate pattern

during this silver bull market. The bulk of each crash lasted

approximately two months, so if this crash follows the same pattern it

should bottom sometime in June. Then silver should stage a recovery

rally. The recovery rally has tended to be followed by a consolidation

period, where silver just grinds sideways. If the crash is the “scare

you out” phase, then the consolidation after the recovery rally is the

“wear you out” phase. The goal of both of these phases is to recreate

the wall of worry necessary to drive the next major rally.

Markets typically need time to repair the damage after a crash and

that is essentially what the recovery rally and consolidation phases

accomplish. It usually takes a period of time and multiple attempts for

a market to overcome the resistance created by a sharp crash.

Therefore silver investors should adjust their expectations and prepare

for a sideways grind after the current crash has run its course.

Expecting silver to race back up to 50 and make new highs right away is

not out of the realm of possibility, but it isn’t probable based on how

markets normally behave.

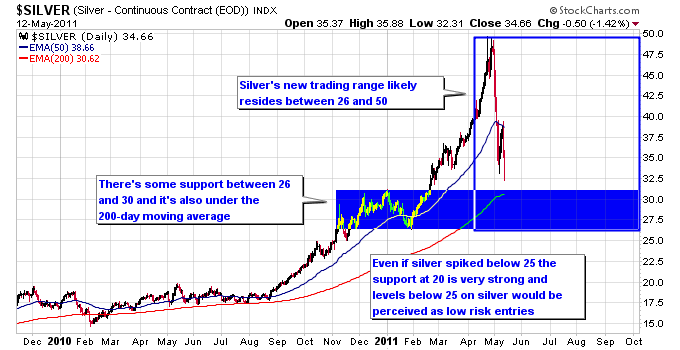

Based on past precedent the new trading range for silver is likely to

be from the mid-20s to the recent high right below 50. There’s some

support on the chart between 26-30 and this zone also resides underneath

the 200-day moving average, so that area would likely prove tough to

penetrate to the downside.

It should be interesting to see how long it takes silver to repair

the damage done before it can attempt to stage a real breakout past 50.

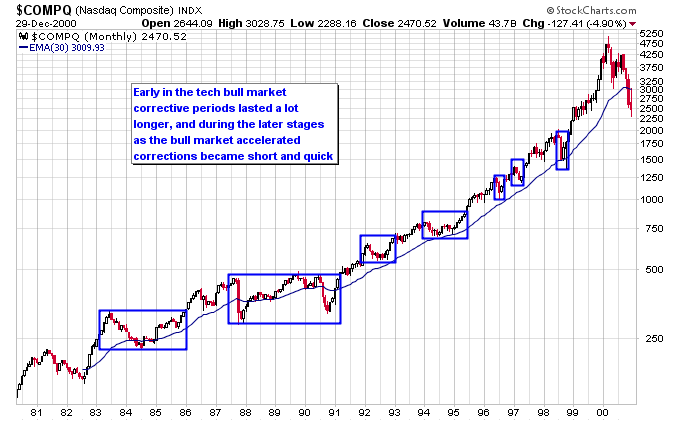

One important thing to note about bull markets is they tend to overcome

corrections quicker as the bull market becomes more mature and

accelerates to the upside. This next chart of the tech bull market

shows how the market consolidated for years at a time early in the bull

market, but later in the bull market it only took a matter of months to

complete each consolidation period.

next.big.trade.com